Oasis Financial. Legal Funding

- April 21, 2020

- admin

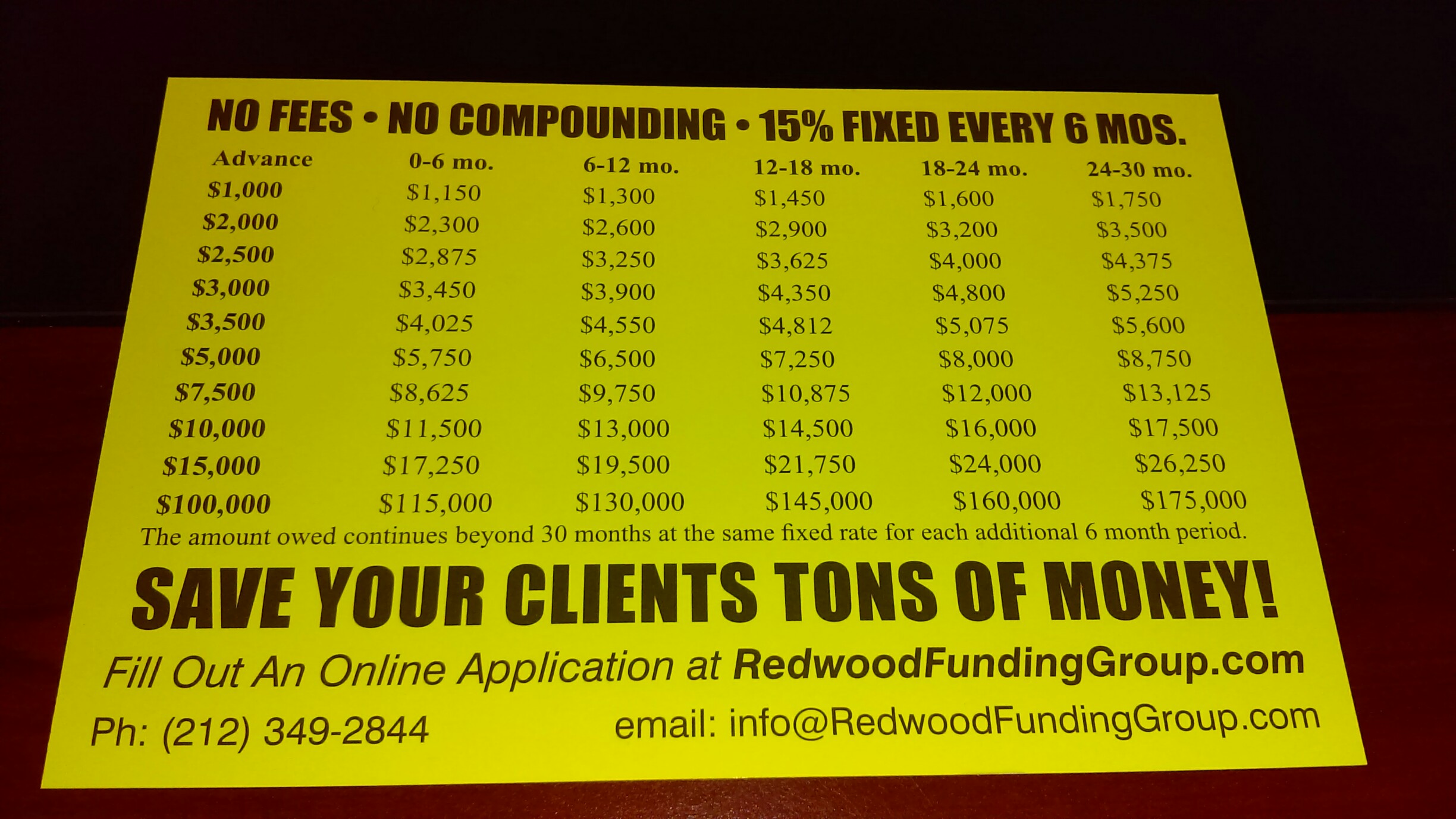

Redwood Funding Group never charges fees and never compounds the interest. One Fixed Rate of 15%. Borrow $1,000, You Owe $150 Every Six Months. That’s It!.

Legal Funding by Redwood Funding:

Legal Funding will help lower the stress of a serious car accident. Why? Regardless of your injuries and medical condition, you still have the same bills and expenses to pay. A lawsuit can take months or even years to settle or go to trial. Do you have that time to pay your bills without money coming in? A Legal Cash Advance from Redwood Funding will pay those bills and allow you to recover and fight for every dollar in your lawsuit.

Accident Insurance Companies:

Everyone in a lawsuit has somebody who you claim is responsible for your accident and injuries. The problem is they usually don’t admit guilt and definitely don’t want to pay for your injuries. All of these people are represented by large insurance companies. These insurance companies are worth billions of dollars. They have the money and time to delay and delay your case. They do this for 2 reasons. 1) They know that the longer the case takes the more likely you will take less than it’s real value. 2) they make interest on the billions of dollars they are holding back from your settlement.

You don’t have a billion dollars to fight this lawsuit, do you? Consequently, how are you going to fight these behemoths? A Lawsuit Cash Advance by Redwood Funding is your answer. We will advance you the money you need to pay your bills and expenses. Hence, this will allow you to continue your lawsuit and reap all the money your injuries and case is worth. Fight the insurance companies with the firepower of a Legal Funding by Redwood Funding.

How to Qualify for Legal Cash Advance:

There are dozens, if not hundreds, of Legal Funding companies. Each have their own set of criteria for getting a Legal Cash Advance. Most have the following criteria: 1) You need to be an accident victim represented by an attorney. 2) You need to have a likelihood of success in your lawsuit. Why? Because if you lose your lawsuit you don’t have to pay any money back.

Legal Funding companies want to make money. It is a business. They are not going to lend you money if they don’t think you will be able to pay it back. Therefore, if you meet the above criteria, almost all Legal Funding companies will advance you money. The amount of money will depend on the value of your case, liens applicable to your case and the availability of someone, like an insurance company to pay on the settlement or trial.

Legal Funding Costs:

A Legal Cash Advance costs you nothing unless you win your case or settle. If you win or settle the lawsuit you will have to pay back the principal [amount borrowed], interest and most often, fees.

It is up to you to decide which Legal Cash Advance company offers the best interest rate with the lowest or no fees at all. Many if not most Legal Cash Finance companies will charge a monthly compounded interest rate. Do not be fooled by advertisements of 3% or 4% interest. These probably mean 3% or 4% monthly compounded interest. This means the interest is compounded monthly and is about 75% a year! Look for fixed interest rates only.

If the Lawsuit Cash Advance Company charges fees you are in for trouble. Believe it or not, some companies charge application, processing, management, underwriting, opening or closing fees. These fees can be in the hundreds of dollars, in addition to, the principal loan you are taking out. Furthermore, many companies deduct the fee out of the loan you are receiving. For example, if you are borrowing $2,000 and the fee is $250, you are only receiving $1,750. However, the interest you are paying is on $2,000. Try and use a Legal Funding Compnay company that charges no fees.

Incidentals: Delivery of Funds:

Finally, all Lawsuit Cash Advance companies offer various methods to send you your money. Most of them will charge you a premium over and above what it costs them to send you your money.

For example, one company charges a sliding scale, depending on how much you are borrowing, when calculating what a bank wire will cost you. Some companies charge as high as $150 for a bank wire or Federal Express that only costs them $30. Remember our example above about the deduction for fees? These same companies will deduct for the cost of delivery of the funds. In our example, where you will receive $1,750Â on a $2,000 loan? After deducting the $150 for the delivery, your check will only read $1,600. However, again, you are paying monthly compounded interest on $2,000. Robbery?

Lawsuit Cash Advance By Redwood Funding:

Redwood Funding never charges fees in any form. We also never compound our interest, ever. We have one fixed rate of 15% of what you borrow for each six months you have the money. Borrowing $1,000? You will owe $150 every six months. That’s all. We are so confident that we have the cheapest Legal Funding rates in the rates that we have a chart on this website showing exactly how much you owe for various loans.

See also:

https://www.facebook.com/redwoodfunding

https://redwoodfundinggroup.tumblr.com/