Injury Loans-Accident Funding-Georgia

- September 27, 2019

- Jeffrey A. Rubin

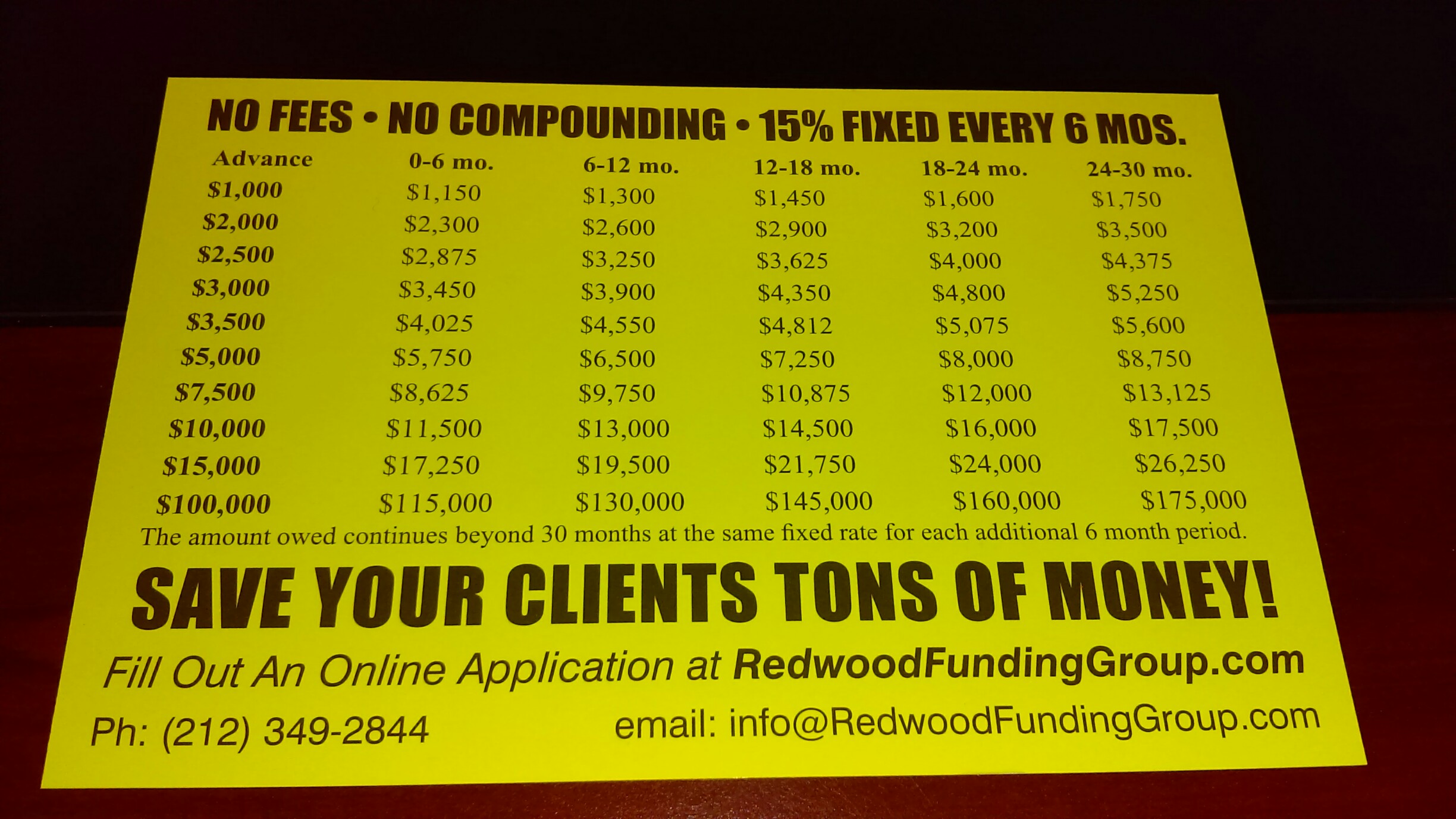

Injury Loans with No Fees & No Compound Interest, Ever. Just 15% Fixed For Every Six Months That You Have the Money. Unbeatable! See our Table & Compare.

Can You Get An Accident Funding?

Can My Lawyer Loan Me Money?

How Does Accident Loans Funding Work?

First, after you apply for an lawsuit loan, the funder will request information about your accident from your lawyer. Hence, the accident funding company will ask about the accident, injuries and the value of the case.

How Much Do Accident Loans Cost?

Lawsuits take months or even years to settle or come to trial. Moreover, the interest rates on a typical lawsuit loan can run between 27% and 60% a year, comparable to some payday loans. Consequently, on a $25,000 loan, the interest can cost you $12,500 or more in just one year.

What is Compound Interest?

Compound interest is the addition of interest to the principal sum of a loan from the previous period. In other words, interest on top of interest.  Hence, interest in the next period is charged on the principal sum plus previously amount of interest.

What is the Difference Between Accident Funding Companies?

Most noteworthy, Redwood Funding is the only accident funding company that a fixed interest rate of 15% with no fees. Furthermore, the big accident loan companies are Oasis Financial, Cherokee Funding, Global Funding, Buckeye Funding. Finally, many of these companies charge a monthly compounding interest rate that can really mean interest as high as 70, 80 or 90% a year.

How Do You Choose a Lawsuit Loan Company?

Since you are looking for a lawsuit loan company people are most interested in the bottom line: cost. Noteworthy, people want cheap and fast service. However, lawyers do not like dealing with accident loan companies. In conclusion, awyers usually do not get paid for the extra work in providing the information needed by these accident loan companies.

Who Is The Cheapest Accident Loan Company?

Redwood Funding Group is the cheapest lawsuit  funding company. Additionally, they never charge fees in any form. Lastly, they don’t compound the interest rate. Finally, they don’t overcharge for the service of a bank wire or Federal Express.