South Carolina Accident Loans

- January 7, 2019

- Jeffrey A. Rubin

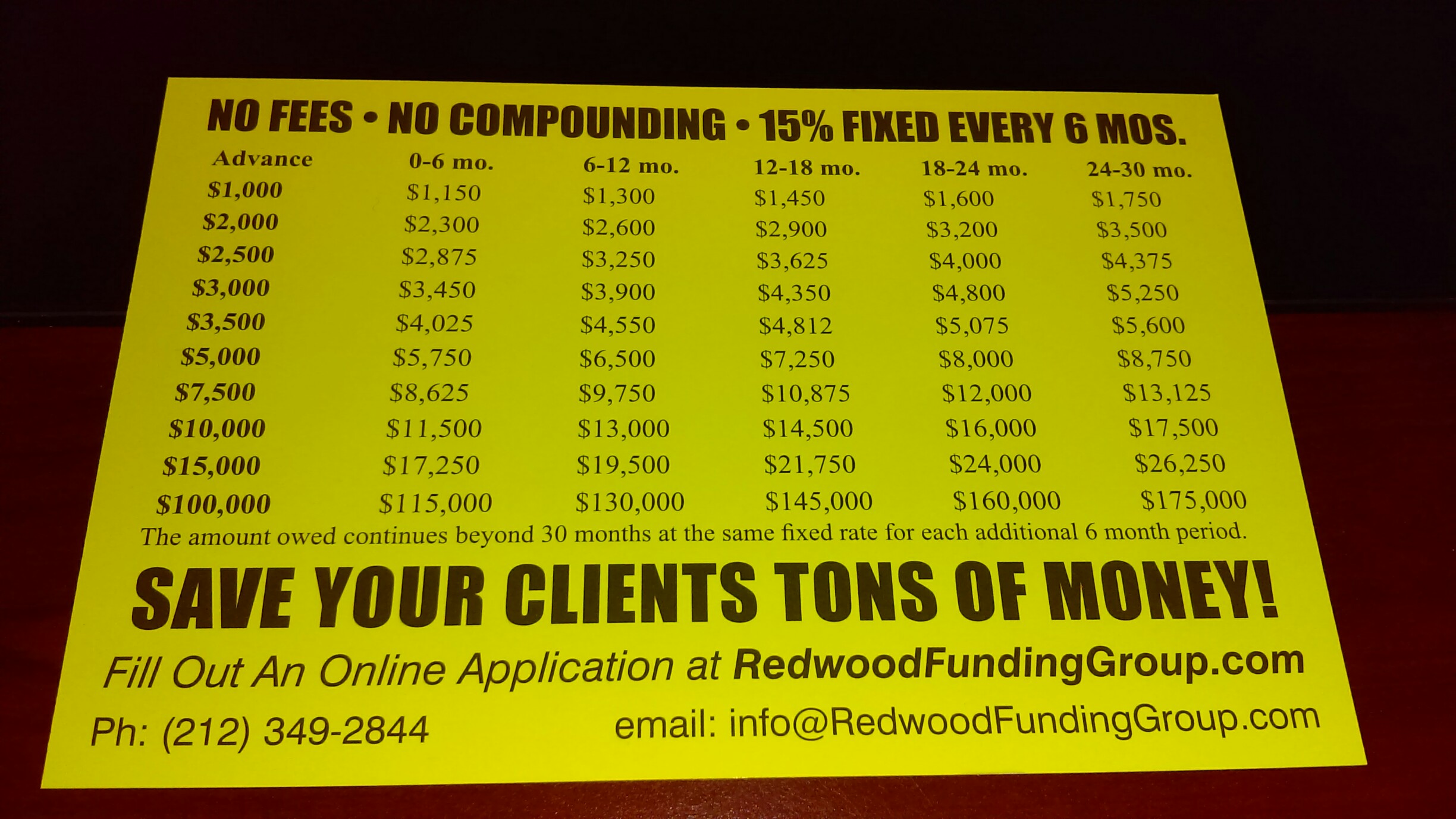

Pre Settlement Loans with No Fees & No Compound Interest, Ever. Just 15% Fixed For Every Six Months That You Have the Money. Unbeatable! See our Table & Compare.

Accident Loans:

Are you from Charleston or Columbia? Have you been hurt in South Carolina? Due to the accident have you lost your job or are unable to work? You have bills piling up. The rent is due, car payments, insurance payments, food. You have a great case but you also can’t start or continue your lawsuit unless some miracle happens.  A friend of yours told you that there are companies that do pre settlement loans in South Carolina out there that will advance you money today in exchange for down the road getting the advanced money back plus interest. You think it’s a great idea and will really help your situation. You need South Carolina Accident Loans & South Carolina Legal Funding.

What are your options? You start looking through the internet for the best pre settlement company out there. You are overwhelmed by all the different accident loans or accident funding companies and you don’t know where to begin. Some companies tell you that they are the fastest. Others tell you that they have the best rates. Some say they have the best service. How are you going to figure out which pre settlement funding company to use? We are going to explain the process in picking the Best Accident Loan Company in South Carolina right here:

The Search for Accident Loans & Lawsuit:

Start with your lawyer.  Lawyers do not approve of their clients getting accident loans. Why? Most of all the reason is that the lawyer do not want the client to have to owe people money out of the settlement. The lawyers want a happy client. If the client does not get any money from the lawsuit they are not going to be happy. Therefore, a lawyer might discourage the client from taking pre settlement funding or lawsuit loans. However, there are cases where a lawyer might approve of accident loans. Furthermore, the lawyer might know some companies that are cheaper than others.

Here is what you should look for in an accident loans company? Ask yourself, what is the most important criteria when getting lawsuit loans? Easy. Especially relevant is how much the advance or loan is going to cost at the end of the day. Hypothetically, if you go to a bank for a car loan, you want to know how much it is going to cost in total. You want to know if this bank is giving you a better than the bank across the street, right? Same thing applies when looking for Texas accident loans or pre settlement loans in South Carolina.

Monthly Compound Interest:

There are many accident loans funders out there. You need to know what to look for. First of all, the most important thing to look for when searching for pre settlement funding is price. What will it cost you to borrow a certain amount of money over a certain period of time? Most funders will try and attract you with what sounds like a really small amount of interest that you will pay for the cash advance. They might advertise something like 3% or 4% interest. Sounds great right? You got to ask the right questions. Does that mean 4% interest on the principal amount of money that you are getting? Does that mean 4% interest a year or what?

Great questions! most South Carolina Accident Loans companies will advertise those great looking 3% or 4% interest but what they really mean is 3% or 4%Â monthly compounded! Do you know what 4% monthly compounded comes to after one year? Most noteworthy about 75%. Wow!. So that little advance of $1,000, just based upon the monthly compound interest will be $1,750 after one year.

Fees:

However, there’s more to worry about. You have to know whether the South Carolina Lawsuit Loans & South Carolina Legal Funding companies are going to charge you a fee in some form. They might charge you an application fee, a processing fee, an underwriting fee, a management fee or a closing fee. Some settlement loans in Texas might charge you one, some or all of these fees together. We have seen that happen!. Let us take a very conservative estimate and say that the fee total for all fees is $250. Hence, this means that the $1,000 advance will cost you $250. Meaning the pre settlement funding will take a $250 fee out of your $1,000 advance and give you $750. There’s a lawsuit in there somewhere!

In addition, there is even more to be concerned about. Most South Carolina Lawsuit Loan funding companies will add the fee to the amount of money that you are responsible for. Remember that $1,000 that you are borrowing? they will add $250 to it and make you responsible for 4% monthly compound interest on $1,250!. However, keep in mind that you are only receiving $750 because they took the $250 fee out of your advance.

Wires & Federal Express:

There’s even one last thing to worry about. How are you getting your money? Most pre settlement loans and South Carolina Accident Loans companies will charge you $75-$85 to wire or Federal Express you the money. So now we are deducting $75 from the $750 and you are now getting $675.

What’s the bottom line? You are taking out a $1,000 advance but only getting $675. You are taking out a $1,000 advance but before seeing any money you are paying a $250 fee. And finally, before you even have that $750 check in your hand they take out another $75 to send you the money. Do you know what you will owe in about 1 1/2 years? about $2,500!

Redwood Funding Group:

Redwood Funding Group was founded by former personal injury lawyers who know exactly what is going on here. At Redwood Funding Group you will never see a fee in any form. You won’t see what looks like a fee but is called a surcharge or any other word. No fee, ever. You also won’t see compound interest. Not daily, monthly, or yearly. Just no compound interest whatsoever. Redwood Funding Group has one fixed rate for Texas Legal Funding. You pay 15% for each six month period that you have our money. You can relax and concern yourself only with your lawsuit.

For example, if you borrow $1,000, like in the case above and you have the money for 10 months that means you are in the second six month period. As stated, at 15% that’s $150 for each six month period. So for 10 months you would owe $1,300. For 2 years, $1,600. Remember the example above where you are being charged for $1,250 but only end up getting $675? With Redwood Funding Group you get $970 because we deduct only $30 for Federal Express and don’t charge you any fees, as stated. So for 1 1/2 years it’s $1,450 vs. $2,500. It’s a no brainer.

For Legal Funding, apply with Redwood Funding Group today by filling out an Application online. It’s that simple.

https://milestone.legalexaminer.com/legal/suit-calls-oasis-legals-interest-rates-unconscionable-unfair-and-illegal/.

For more on legal funding see: https://www.nacle.com/

https://www.google.com/search?source=hp&ei=_-_nXbT4Jarv_Qb4nbSoCQ&q=redwood+funding+group&oq=redwood+funding+group&gs_l=psy-ab.3..0l3j0i22i30l3j38.1030.5055..5571…0.0..0.198.1574.19j2……0….1..gws-wiz…….0i131.umhtGuS9FZw&ved=0ahUKEwj089iuxZzmAhWqd98KHfgODZUQ4dUDCAg&uact=5#lrd=0x89c25a21fd71b501:0x60cd90134c6ecfe4,1,,,