Whose Got Momentum? Redwood Funding!

- March 10, 2020

- admin

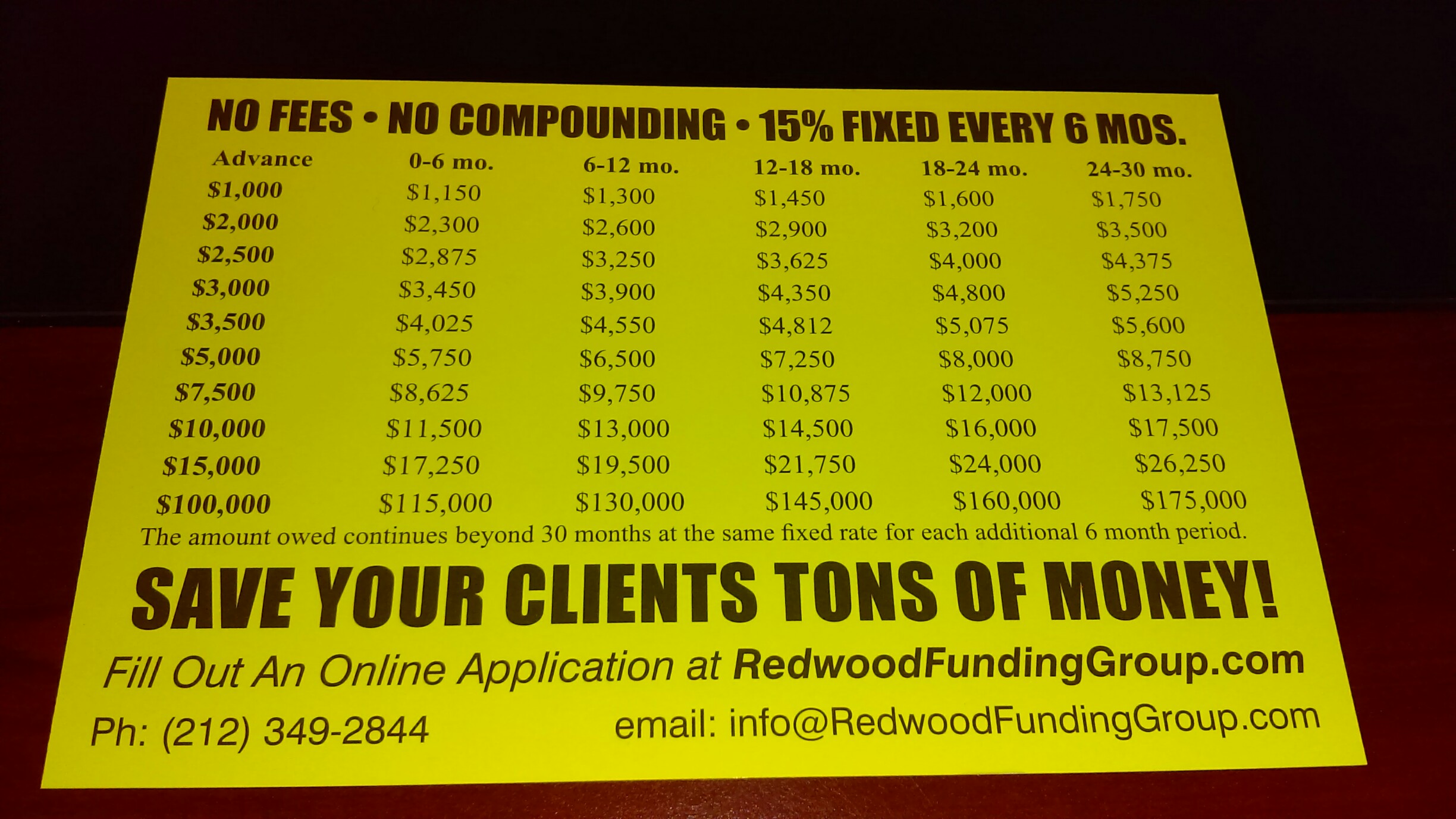

Redwood Funding Group offers Pre-Settlement Funding with No Fees and No Compound Interest. Just 15% of the Principal Fixed Every Six Months.Â

Redwood Funding Group vs. Momentum Funding:

Redwood Funding Group is the cheapest Pre-Settlement Funding & Lawsuit Funding Company in America, not just Florida. Above all, we devote ourselves 100% to providing accident victims with Pre-Settlement Funding at the cheapest rate in the country, guaranteed.

Here’s all you need to do to get started: Fill out an Application here on this website. Once we receive your Application we will request a few documents from your lawyer. When we get those documents we will immediately review them and if approved send you a contract for Lawsuit Funding. Once we get the contract back we will wire or Federal Express you the money. It’s that simple.

A Little Background About Pre-Settlement Funding:

The industry of Pre-Settlement Funding, Momentum Funding included, arose when accident victims who couldn’t pay their bills had nowhere to turn. Consequently, Pre-Settlement Funding companies provide what is called non-recourse loans to accident victims. A non-recourse loan means you don’t pay anything back if you lose your case. In other words, you only pay these advances back if you win or settle your case.

That’s the good news. The bad news is that there are many different Pre-Settlement Funding companies out there. Therefore, you, as the borrower, have to do your homework and find the best Lawsuit Finance Company out there. Is it Momentum Funding or Redwood Funding?

Let’s Find out. What to Look For:

Fees:

Most Pre-Settlement Companies charge fees. These fees may be called processing, underwriting, administrative or opening fees. Similarly, these Lawsuit Funding Companies might also charge   maintenance fees and closing fees. These fees will range in the hundreds of dollars and will be deducted out of your original advance. For example, if you borrow $1,000, your              Lawsuit Funding company might charge a $200 underwriting fees. After deducting that fee, they will send you a check for $800, not the $1,000 you borrowed. However, they will               charge you interest on the $1,000 advance. Redwood Funding has no fees. Does Momentum Funding?

Interest:

All Pre-Settlement Funding Companies charge interest. However, most Lawsuit Funding Companies charge compound interest. Compound interest is interest on top of the previous periods principal plus interest. If the interest is monthly compounded then you can end up owing 75-100% annually. This is a huge amount. On the other hand, some Pre-Settlement Funding Companies charge a fixed amount of interest. This is where the bargains are, at fixed interest.

For example. If you borrow $1,000 at 3% monthly compounded interest, you will end up owing about $1,700 after one year. Does Momentum Funding have a fixed interest rate? Redwood Funding does.

Incidentals:

How are you going to receive your money? All Pre-Settlement Funding Companies offer various methods to getting your you funds. Some offer bank wires, others offer Federal Express, while many offer Western Union. Many Lawsuit Funding Companies will charge you a multiple premium over and above their cost to send you the money. For example, one Pre-Settlement Funding Company will charge you as high as $149 to send you $7,000 by bank wire. Why? a wire only costs about $30 to send. Furthermore, they will deduct that $149 from your loan check.

Using the example above, that $800 you are getting [because $200 was deducted as a fee] is now really just $651. That’s right, you are responsible for a $2,000 advance, plus interest on day one but you are only starting with $651.

What does Momentum Funding charge to send you your money? Redwood Funding doesn’t make a penny on the delivery of your funds!

The Cheapest Lawsuit Funding Company:

Redwood Funding Group is the cheapest Pre-Settlement Funding Company in the country. As noted up above, we charge no fees and never compound the rate of interest. We charge one fixed rate of 15% of your principal for each six months that you have the money. For example, if you borrow $1,000, you will owe $150 for every six months that you have the money. That’s all. Furthermore, if you take the money by wire or Fed Ex, we deduct what the bank or Federal Express charges us, around$30.

https://milestone.legalexaminer.com/legal/suit-calls-oasis-legals-interest-rates-unconscionable-unfair-and-illegal/.

https://www.angieslist.com/companylist/us/nj/teaneck/redwood-legal-funding-group-reviews-9231553.htm

For more on legal funding see: https://www.nacle.com/