Georgia Pre Settlement Funding

- July 3, 2020

- jeffrey rubin

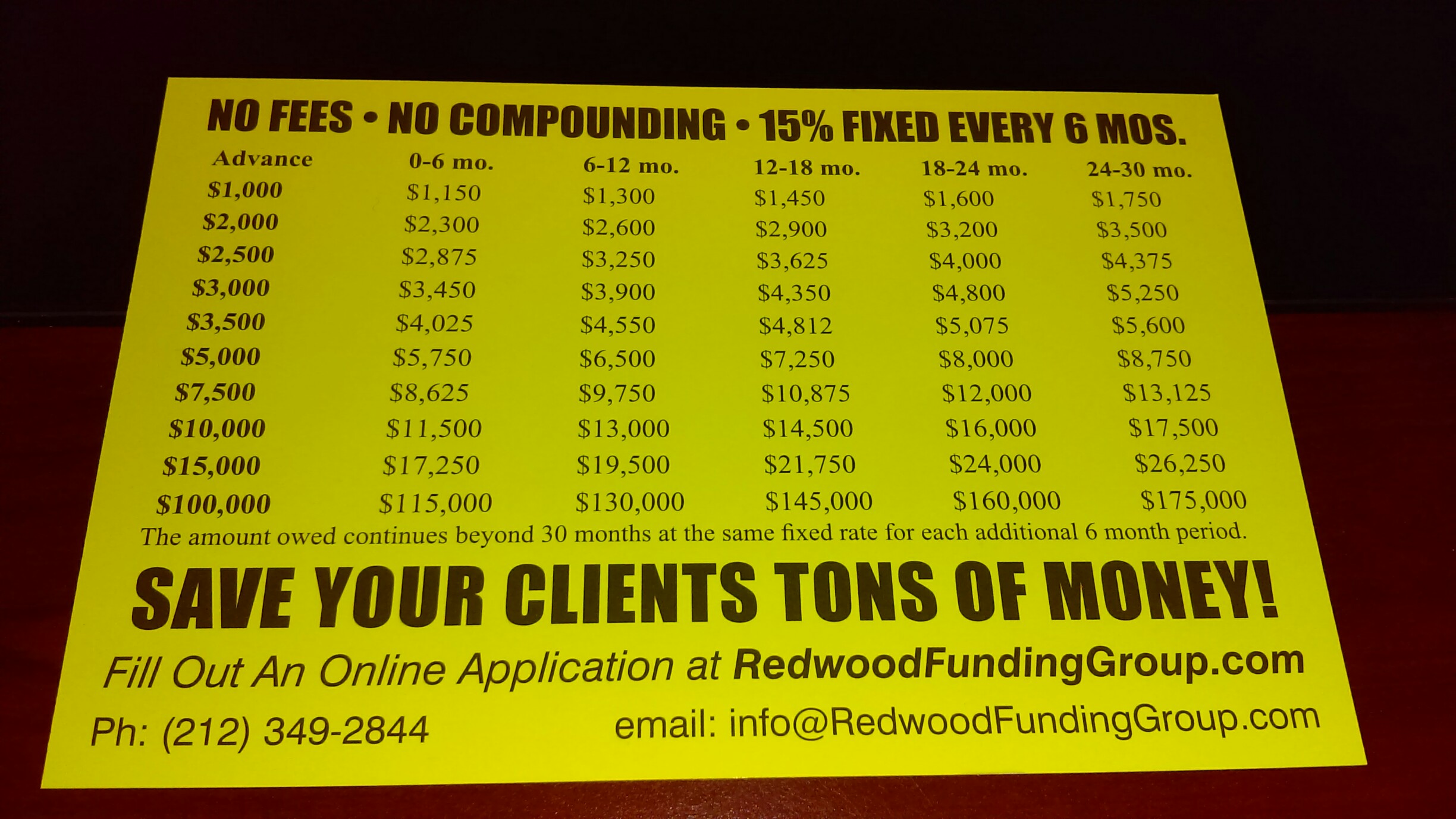

Pre Settlement Funding. No Fees, Ever. No Compound Interest, Ever. One Fixed Rate. 15% of the Principal for Every Six Months You Have the Money. Redwood Funding Group. Apply Now.

Georgia Pre Settlement Funding:

If you are the victim of an accident, whether from Georgia or anywhere else, you might need an Accident Loan. Why? First of all, you might be injured as a result of your accident. Consequently, you might not be able to work. Furthermore, if you can’t work, how are you going to pay all of your regular and now medical bills. This is why you might need a Lawsuit Loan or a Car Accident Loan from Redwood Funding Group.

Say you are from Atlanta, Ga or even Houston, Texas and you were hit by a car. As a result, you were taken by ambulance to the emergency room. Boom! you now have a medical bill. Additionally, once you engage with a lawyer, he or she is going to tell you to build up an injury file. This means that in order to get the biggest recovery you need to prove that you have many serious injuries. Therefore, in order to do that you have have to visit a lot of doctors. Due to your injuries you might need an orthopedist, a chiropractor, an MRI and physical therapy. Boom! you now have a lot of medical bills.

Do you have health insurance. If you have insurance than maybe your bills will be covered. However, your deductible will not be covered and transportation costs to the doctor will not covered. Finally, how are you going to pay for these things? a Pre Settlement Funding from Redwood Funding Group.

Accident Loan Funding:

If you have health insurance, than maybe you can breathe a little easier and not worry about those long term bills. However, what if you don’t have health insurance. Seems like you are up the creek without a paddle. How are you going to get a doctor or therapist to treat you if you can’t pay them. Enter: A Lawsuit Loan from Redwood Funding Group.

Most noteworthy, during this time do you think your electric company, your mortgage company and your phone company are just going to stop sending you their bills? Of course not. Especially relevant, is that while you have all these new medical bills you are still getting smothered by your regular everyday bills. Holy cow! What is there to do? A Car Accident Loan from Redwood Funding Group.

Lawsuit Loan:

Why else would you need a Pre Settlement Loan? A giant insurance company is paying for the lawyer of the person you are suing. That same giant insurance company is eventually going to pay your settlement or verdict. However, do you think they are interested in paying you the full value of your case right away? Not on your life. The giant insurance company has every incentive to make you sweat for your money. Why? for several reasons.

First, the longer they can delay paying you the more interest they can make on investing your soon to be settlement. When you add up all the lawsuits a giant insurance company has, that can add up to a lot of money and interest on it. Consequently, they are in no rush to settle your case.

Most importantly, however, the insurance company knows how cash strapped you are. Furthermore, they know that you can’t keep your lawsuit going forever unless you can cover your bills.

Car Accident Loan:

This is where a Car Accident Loan or Pre Settlement Funding comes into play. Especially relevant for Accident Loans is that it levels the playing filed. If the person you are suing has a giant insurance company with a large war chest fighting against you, you should have some ammunition yourself. A Lawsuit Loan from Redwood Funding will do just the trick.

Whether you are a car accident victim, the victim of a slip and fall or some other kind of accident victim here is why you need that Accident Loan: 1) pay your bills and 2) gives you breathing space to fight for your full value settlement or verdict.

How to Choose The Best Pre Settlement Funding Co:

Seems like there are hundreds of Pre Settlement Funding Companies out there. How do you decide the Best Accident Loan company in 2020? We are going to give you the questions to ask of whatever Lawsuit Loan company you use:

- Do you charge fees to do this transaction? The biggest Car Accident Loan companies are Oasis Financial, BridgewayLF, Nova Funding, FundMyLawsuitNow among others. Many of these companies will charge an application fee, an underwriting fee, a processing fee a management fee, an opening or closing fee. Some companies can charge fees as high as $500. In addition, they will tack on the fee to the amount you are borrowing and charge you interest on the total. Be careful! Redwood Funding never charges any fees.

- Do you compound interest? For example. It is pretty easy to figure out what 4% of $1000 is. It’s 40, correct? But what is 4% monthly compounded of $1000? huh? That’s about 80% interest a year. Are you prepared to pay 4% monthly compounded interest on ANY Lawsuit Loan that you take out? We hope not. Redwood Funding never charges compound interest. We have one fixed rate: 15% of the principal for every six months that you have the money.

- How much exactly will I owe after 1,2 & 3 years. Whomever, you call for your Accident Loan, you should demand to know, in the 1st phone call, how much you will owe for what you want to borrow. If they don’t give you a straight answer, hang up.

Redwood Funding Group: for Accident Loans:

We are so confident that Redwood Funding Group is the Cheapest Pre Settlement Funding Company in Georgia or the entire USA that we put our guaranteed repayment schedule right on our web site. Feel free to use it to compare us to any Car Accident Loan or Accident Loan company in Georgia or elsewhere and we guarantee that you will be calling us back.

Call us at (212) 349 2844 or Apply online NOW! Save big!